New cars can either be registered in the corporate channel or by private individuals. Corporate cars include a diverse array of uses including rentals, demo cars at dealerships, salary cars, and personal cars that are leased from a company. Corporate cars have a significant influence on the German car market. Corporate registrations constitute the majority of new car sales (63%) and, because they are driven twice as much as private registrations, their share of new car CO2 emissions is even greater (76%). After an average ownership period of four years, corporate cars are sold onto the second-market private market.

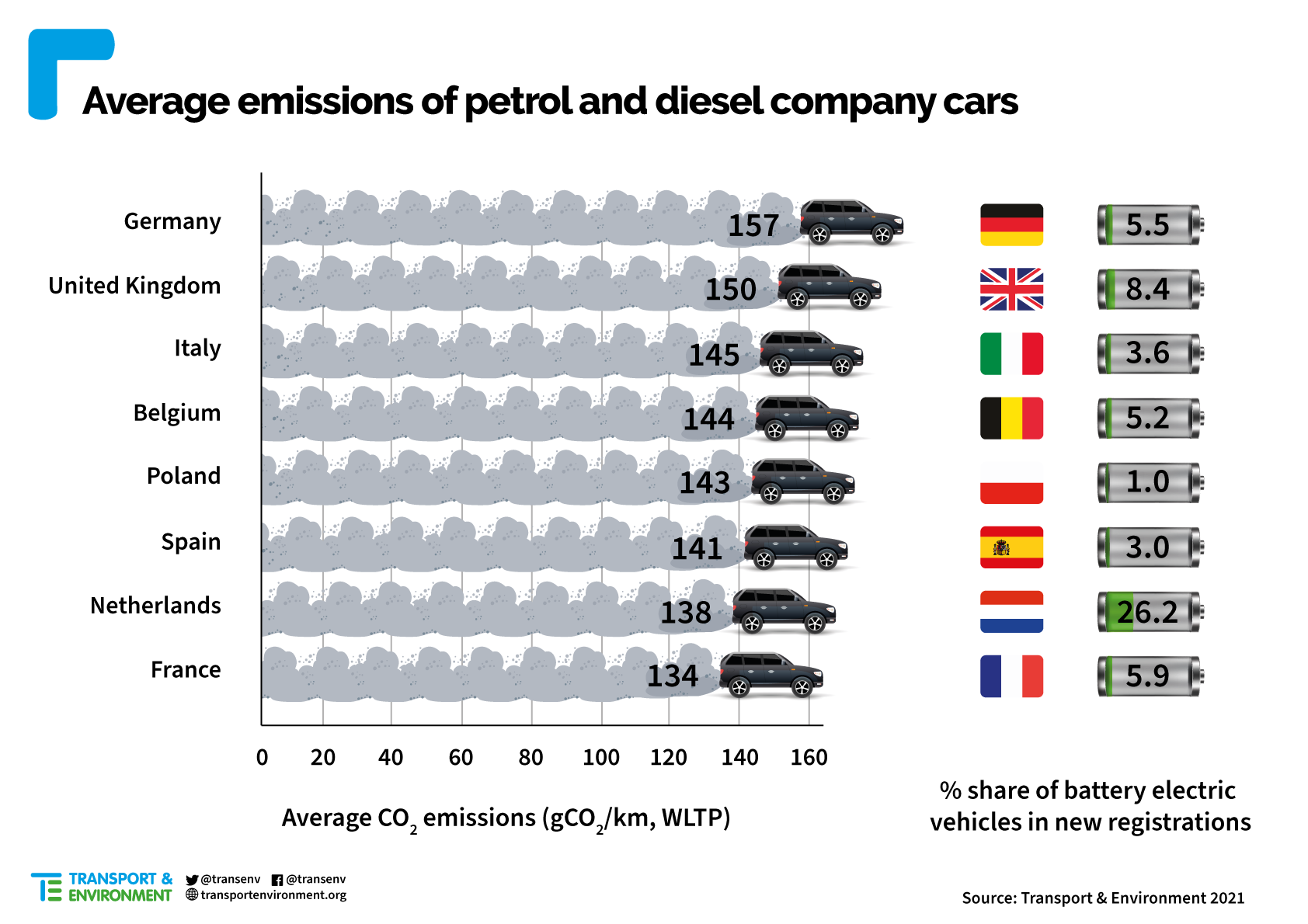

The fleet of corporate cars in Germany is in urgent need of a green transition, with the vast majority of new registrations (87%) still powered by an internal combustion engine (ICE). This is particularly concerning as Germany’s fleet of ICE corporate cars has large numbers of heavier, luxury cars. Average emissions of the ICE corporate fleet are higher in Germany than all other major European markets (the UK, France, Italy, Spain, Poland, Belgium, the Netherlands).

This failure to tackle emissions from corporate cars is holding back Germany’s climate ambitions. In 2020, the emissions of the new corporate cars in Germany reached 7.4 million tonnes of CO2. This equates to 4% of Germany’s total transport emissions from new registrations alone.

Low uptake of electric cars

The average emissions of Germany’s ICE corporate cars could be pulled down if electric cars (EVs) were registered in greater numbers. This is not taking place, however, with Germany trailing the Netherlands, the UK, France, and many smaller markets.

Furthermore, Germany is the only major European market where EV uptake is lower among corporate cars than private cars. In all other major European markets, company cars are leading the way on electrification as the financial case for electrifying cars is stronger the more they are driven and when viewed as a long-term investment — both of which apply to the corporate fleet.

Germany’s incoherent car incentives: all bonus, no malus

To explain this German puzzle, it is necessary to turn to policy. While Germany incentivises EVs through a purchase subsidy and reduced benefit-in-kind (BiK) taxation for the private use of EV corporate cars, it fails to levy significant taxes on high emitting ICE cars. Thus Germany comes up short by effectively subsidising both EV and ICE cars. This means there is a much weaker incentive for companies to purchase electric cars compared to the UK, France, or the Netherlands.

Whereas most European countries levy an increasing registration fee based on emissions (up to €30,000 in France), Germany has a basic €26 fee for all cars. On the private use of salary cars, Germany again takes a relatively flat approach, taxing all polluting cars at a similar level regardless of their emissions. In the UK, the BiK tax rate is twice as high as in Germany for the highest emitting cars (37% compared to 18%). And when it comes to powering cars, Germany has low taxes on fuel, high taxes on electricity, and when combined, the weakest incentive to power with electricity in all of Europe.

Plug-in hybrid electric cars: Public money but no strings attached

Even Germany’s approach to encouraging EV uptake is marred by incoherent incentives. Plug-in hybrid electric vehicles (PHEVs), of which more than 70% enter the corporate car channel, have emit nearly as much as ICE cars under real-world conditions due to the lower power of the EV motor, poor design features, aggressive real-world driving, minimal charging, and the fact that PHEVs tend to be larger than ICE cars.

In light of these real-world emissions, subsidies for PHEVs represent extremely poor value for public money. German policy is among the worst, as the PHEV eligibility requirements for tax benefits is limited to meeting just one of two conditions: an electric range of 40 km or a WLTP of 50 g CO2/km. In practice, this short range limit is meaningless as all PHEVs are over the limit with the sole exception of the Ferrari SF90 (six registrations). As a consequence, 99.995% of PHEVs were deemed eligible for tax benefits including the BMW 7 Series, Porsche Cayenne Turbo S, Mercedes S Class — all cars sold in excess of €100,000 (before VAT). Our estimate is that the 145,000 corporate PHEVs registered in 2020 will be subsidised by nearly €1 billion over a four-year holding period.

Policy recommendations

While Germany’s policy failures are many, the good news is that Germany is well-suited for the electrification of corporate cars. The financial case for EVs is favourable and becoming stronger every year. It is also clear from the high EV uptake among private cars that Germans are as keen on EVs as Europe’s leading markets.

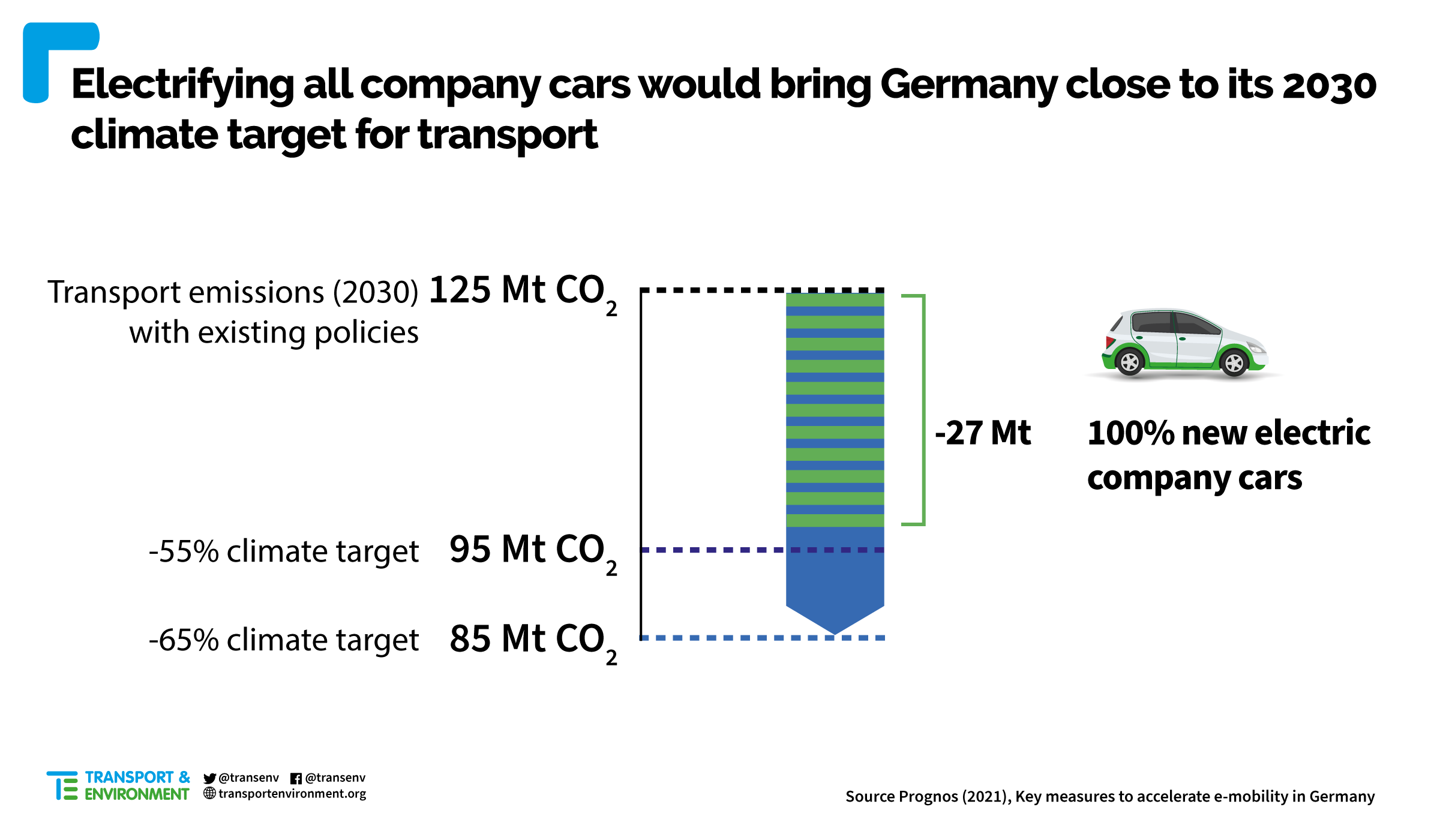

With the right incentives for the corporate fleet, Germany could significantly reduce emissions across the entire fleet as the corporate fleet is the channel to the second-hand car market. Analysis by Prognos has calculated that transitioning all new corporate registrations to zero emissions by 2030 would cut CO2, NOx, and particulate matter by over 30% for the total car fleet. The emissions savings would also enable a large part of the emissions reduction that is necessary to achieve the 2030 national climate targets in the transport sector.

The German government should introduce the following five measures to help the transition the corporate fleet:

- Introduce a target of 100% electric corporate cars by 2030, including intermediate targets for large fleets in 2024 and 2027;

- Phase out VAT deductions and depreciation write-offs for ICE cars;

- End the low tax treatment for ICE salary carsby increasing benefit-in-kind taxation based on CO2 emissions;

- Implement a car registration tax that steeply increases with emissions, for example by scaling up the existing Kfz Steuer and introducing a higher rate in the first year;

- Reduce PHEV subsidies on purchase, reform the BiK taxation, and strengthen the requirements for PHEVs in the Elektromobilitätsgesetz.

Germany’s approach to corporate cars is slowing the transition to cleaner, electrified transport in Germany. But where previous policy has failed, the next government can seize the opportunity and use new corporate registrations to catalyse the transition.

This briefing was originally posted by Transport & Environment here.